Sba 504 loan calculator

An SBA 7a loan can be used for short-term or long-term working capital and to purchase an existing business refinance current business debt or purchase furniture fixtures and supplies. Borrowers also must have a reasonable amount of their own equity to invest in the business.

Spedco Sba Loan Calculator Amazon Com Appstore For Android

Under the 504 loan program the SBA partners with certified development companies CDCs to provide up to 55 million to finance fixed assets such as machinery buildings or land.

. CDC504 loan rates are based on the 5- and 10-year treasury rates plus a spread to the bond. An SBA 504 loan is a type of SBA loan that is used specifically to purchase fixed assets to upgrade existing assets or to purchase real estate. LTVs go up to 90 and may be used for construction or existing properties.

Small Business Advisors Business Loan Calculator FAQ Videos Credit 101 Resource Center Veteran Business Loans Refer A Client. This is the most popular type of. SBA loan rates as of July 2022.

Use this simple tool to explore SBA 504 financing options. When you get an SBA 504 loan you can expect to save on costs. Since 1980 weve partnered with lenders in Washington Oregon Alaska and Northern Idaho to provide loans for small businesses in the Northwest.

504 Calculator 504 Basics Forms Documents and Explanations WBD Opportunity Fund Tools for Lenders WBD Video Library COVID Premier Partner Login. There is no maximum amount you can borrow on a CDCSBA 504 loan. The interest rate will tell you a lot but to fully understand the cost of an SBA loan youll need to have more information including the APR and the total cost of borrowing.

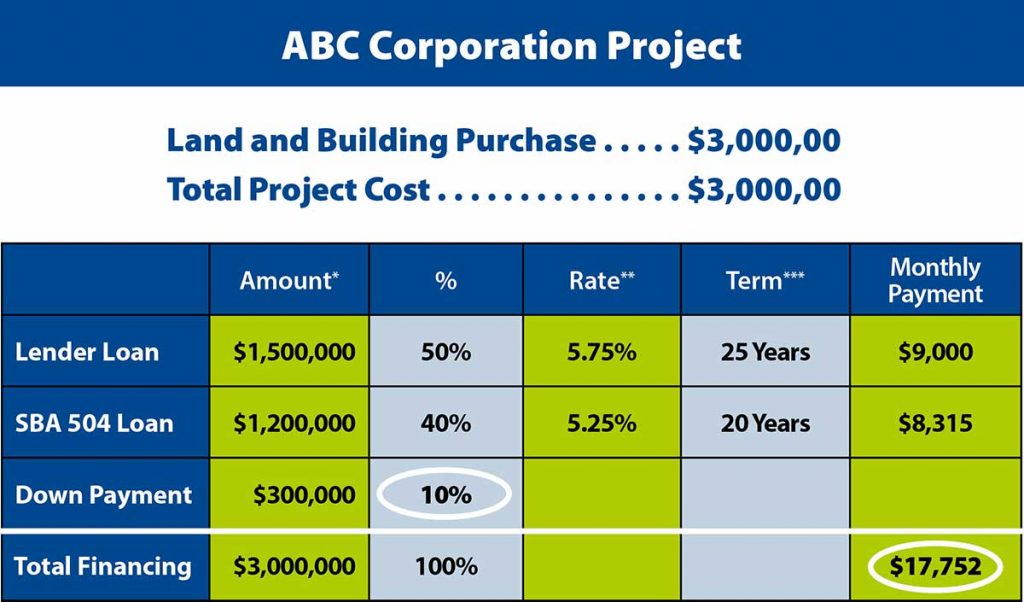

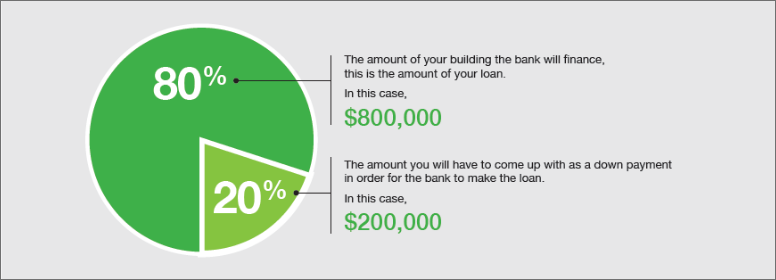

For Owner-Occupied Commercial Real Estate loans OOCRE owner occupancy of 51 or more is required. Typically with a 504 loan a bank extends half the total loan amount SBA-approved certified development companies CDC extend 40 of the loan amount and the borrower puts down a down payment to cover the rest. Bank is proud to be an SBA Preferred Lender specializing in providing Small Business Administration SBA loans.

SBA Express Loan Rates. 504 Effective Interest Rates. SBA 7a Loan Amounts Maturity Interest Rates and Fees.

To be eligible for an SBA 7a loan a business must operate for profit in the US. 50 from the CDC 100 SBA-guaranteed. SBA 7a Loan Calculator.

Both the Board and the staff are dedicated to the goal of assisting small business customers throughout the state of Iowa in their financing needs. The results of this tool are. An Express loan is a type of 7a loan that offers borrowers faster approval times than other SBA loans24 to 36 hours.

Home financial business loan calculator. The SBA 7a loan might be right for your business so we want to make sure you have all of the information you need to make a decision. Small Business Administration SBA Loans Trust your business to a Preferred SBA Lender.

SBAs table of small business size standards helps small businesses assess their business size. 50 of the money comes from a bank or lender 40 from a local community development corporation CDC and the remaining 10 being the borrowers down payment. Funding for the loan comes from three entities.

SBA 504 loan program is a unique financing option that can be used to finance fixed assets such as commercial real estate or equipment. Acquisition improvement or new construction of fixed assets including owner occupied commercial real estate as well as equipment with a useful economic life of 10 years or more can be financed by a 504 loan. Small Business Administration SBA financing is subject to approval through the SBA 504 and SBA 7a programs.

IBGs various programs including the SBA 504 loan program and the New Markets Tax Credit Program all enhance rather than duplicate or compete with the lending community that it serves. Evergreen Business Capital is the Northwests leading Small Business Administration SBA Certified Development Company CDC Loan Program expert. Low fixed interest rates are available for up to 25 years.

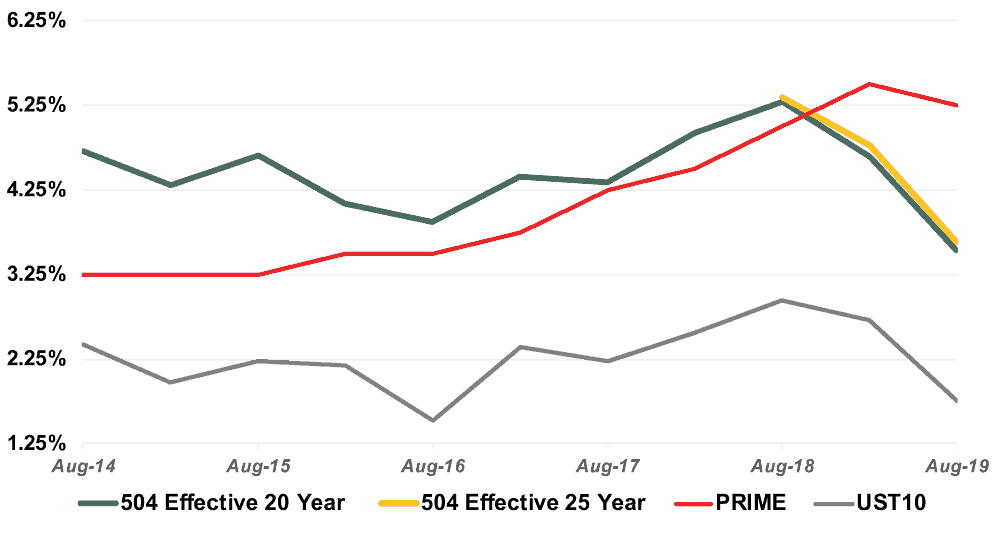

Almost all soft costs can be included. Currently SBA 504 loan interest rates are 466 for a 20-year loan and 449 for a 10-year loan. Content-managed text for the Break-Event Point Calculator.

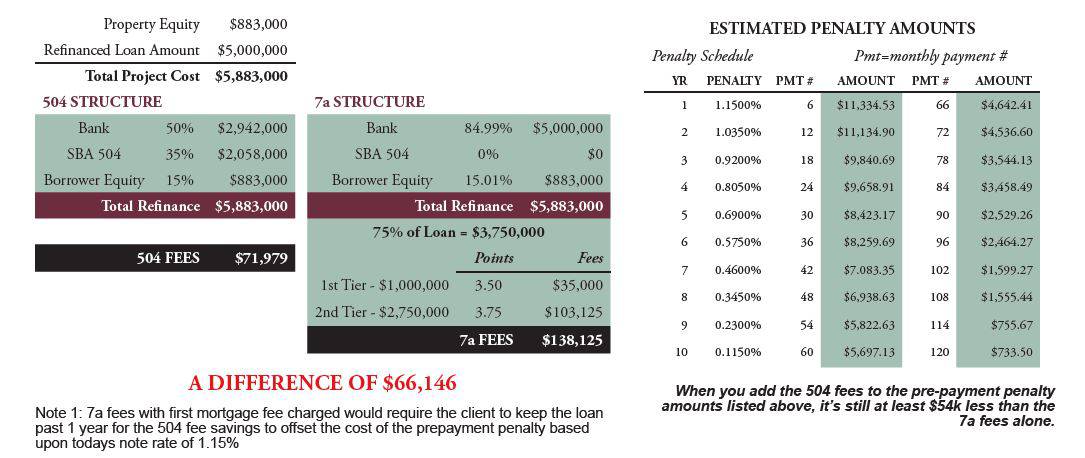

Learn more about business loans. As part of our commitment to the growth of small businesses nationwide US. Unlike other SBA loans the SBA 504 loan program offers lower up-front fees and fixed interest rates a huge bonus given the recent trend of rising interest rates.

Please dont use this calculator for calculating interest rates or payments on SBA 504 loansThe SBA 504 loan consists of two separate loans and our calculator isnt set up to accurately calculate this loan product. Depending on your industry and loan requirements you could qualify for up to 55 million to buy real estate and equipment. An SBA 504 loanor CDC504 loanis a financing program the SBA offers to promote business growth and job creation through the purchase or improvement of real estate equipment and other fixed.

With an SBA 504 loan money can be used to buy a building finance ground-up construction or building improvements or purchase heavy machinery and equipment. General Info Loan Experts Locations. When your small business is looking to grow or expand SBA loans can have many benefits such as.

If you want a basic working capital loan and youre not in a hurry for example youll probably just want to stick to an SBA 7a loan. Free business loan calculator that deals with complex repayment options and returns real APRcost of a business or SBA loan. Designed specifically for the purchase of commercial real estate properties a CDCSBA 504 is like two loans in one.

If you need to calculate payments for an SBA 504 loan many community development corporations can provide those calculations for you. 504 Effective Interest Rates. How SBA CDC504 Loan Rates Are Determined.

This page includes the details of the SBA 7a loan terms and rates as well as specifics about loan amounts and maturity ratesAlso if youre making an SBA loan checklist you. Actual loan terms loan to value requirements and documentation requirements are subject to product criteria and credit approval. 504 Effective Interest Rates.

If you need less money but you need it fast an SBA Express loan might be more your speed. Borrowers typically take out CDC504 Loans for long-term fixed-rate financing of real estate or equipment and debt refinancing. Heres the current SBA 504 loan rates and history updated monthly.

Up to 40 from a bank credit union or another approved lender. And if youre planning an intensive real estate project you may want an SBA 504 loan. SBA 504 Loan Rates SBA 504 is a loan product guaranteed by the Small Business Administration for the financing of owner-occupied real estate andor machinery and equipment.

Financed through the SBA 504 Loan Program with Business Finance Group.

504 Loan Calculator Evergreen Business Capital

Sba 504 Pace Flex Pace Dakota Business Lending

Sample Project California Statewide Cdc

June 2022 Sba 504 Rates Bfc Business Finance Capital

What Is The Difference Between The Sba 504 Loan And The Sba 7a Loan Dakota Business Lending

Sba 504 Loan Definition Rates Calculator Programs

Sba 504 Loan Calculator Free Loan Calculator Tmc Financing

The Sba 504 Loan Bfc Business Finance Capital

Addressing Myths About Sba 504 Loans Growth Corp

504 Loan Program Mcdc

Sba 504 Loan 101 What Is A Debenture And How Does It Work Bfc Business Finance Capital

Sba 504 Loan Calculator Free Loan Calculator Tmc Financing

504 Loan Calculator Big Sky Economic Development

Sba 504 Loan Estimate Your Monthly Payment Growth Corp

Very Low Sba 504 Interest Rates Growth Corp

504 Loan Calculator Big Sky Economic Development

Build